south san francisco sales tax 2019

South San Francisco CA. South San Francisco 5 Sales Tax.

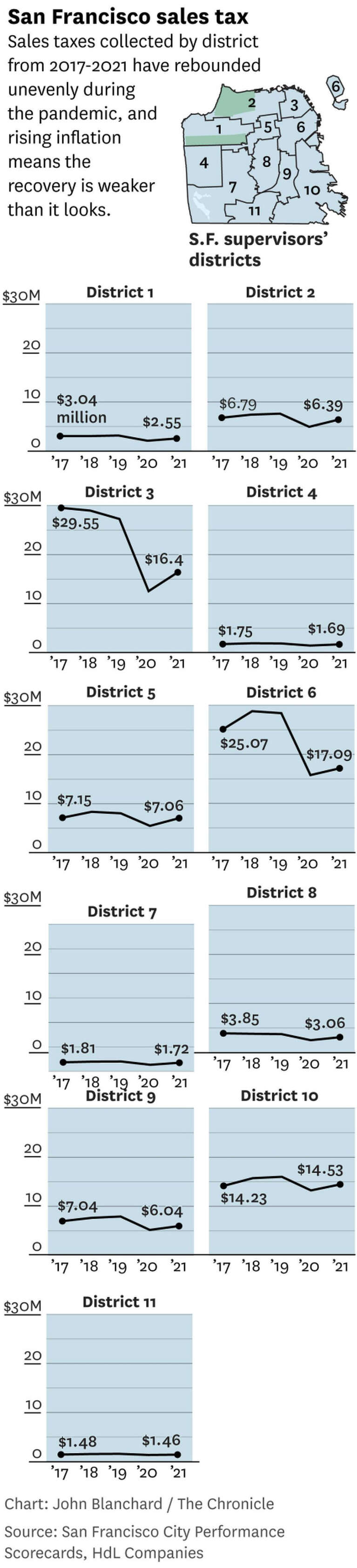

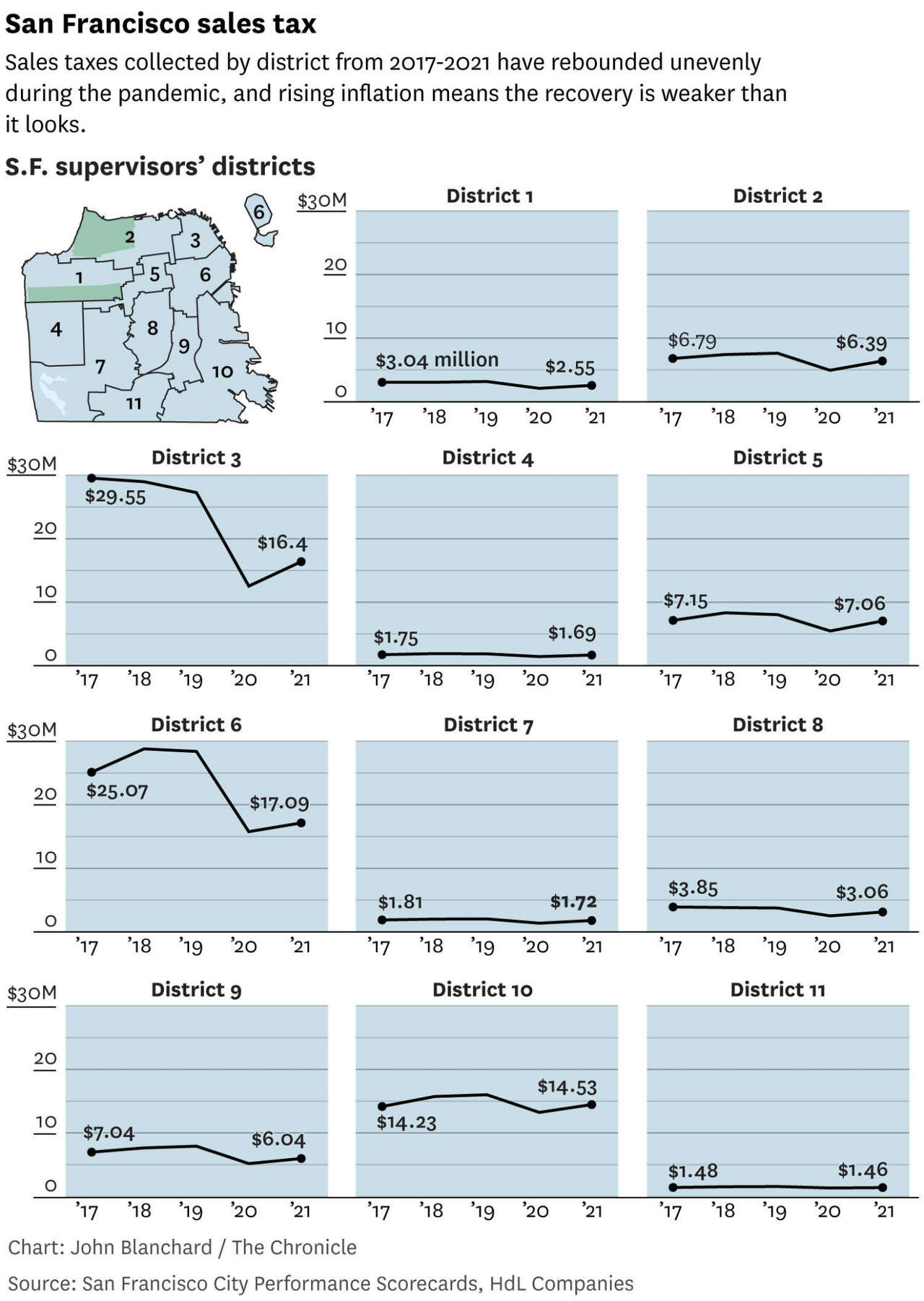

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

ORD 1582-2019 File Number.

. Property taxes are collected by the County Tax Collector for the City and various other taxes are collected by the State and remitted to the City. The current total local sales tax rate in South San Francisco CA is 9875. Next to city indicates incorporated city City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc.

Do Your 2021 2020 any past year return online Past Tax Free to Try. ELECTION 2014 - June 3 San Benito County ballot measures. Rents tax6 Unlike Manhattan San Franciscos Commercial Rents Tax will be imposed on the landlord not the tenant7 Gross receipts from a lease or sublease will be taxable at the following rates8 35 tax on gross receipts from the lease of commercial space.

3 beds 1 bath 910 sq. The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years. Library Director South San Francisco 2019.

2022 Cost of Living Calculator for Taxes. This is the total of state county and city sales tax rates. 2022 Cost of Living Calculator for Taxes.

This is the total of state county and city sales tax rates. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. The California sales tax rate is currently 6.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. Sales Taxes Amount Rate South San Francisco CA. Ad New State Sales Tax Registration.

South San Francisco California and Dallas Texas. South San Francisco CA. When the South San Francisco City Council requests voters grant them a sales tax hike like Measure W what are they.

Sales Taxes Amount Rate South San Francisco CA. In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020. The minimum combined 2022 sales tax rate for South San Francisco California is.

November 2018 Elections - Santa Clara. And 1 tax on gross receipts from the lease of warehouse space. People also ask what is the sales tax in San Francisco 2019.

Ad Lookup Sales Tax Rates For Free. Currently the cumulative tax on retail sales in South San Francisco is 9 of the purchase price. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 1 P a g e Note.

Easy Fast Secure. Easy Fast Secure. There is no applicable city tax.

House located at 660 Railroad Ave SOUTH SAN FRANCISCO CA 94080 sold for 1100000 on Jul 31 2019. The South San Francisco sales tax rate is. Charming Marina-style starter home with expansion.

Offering the property at public auction allows the collection of past due taxes. South San Francisco California and Boston Massachusetts. South San Francisco.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The phone number for general tax questions is 1-800-400-7115. For questions regarding property tax collection please call 650 363-4142.

Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. The South San Francisco Sales Tax is collected. Next week residents of South San Francisco will vote on Measure W -- the plan to raise the sales tax from 9 to 95 percent.

New San Francisco Business Taxes in 2019. Interactive Tax Map Unlimited Use. The San Francisco sales tax rate is 850.

Did South Dakota v. The County sales tax rate is. The December 2020 total local sales tax rate was 9750.

Argument Against South San Francisco Sales Tax Measure W. South Shore Alameda 10750. What is the sales tax rate in South San Francisco California.

The California sales tax rate is currently. CA Sales Tax Rate. The County sales tax rate is 025.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles Agua Caliente 8125 Sonoma. California Sales Tax Rates information registration support. On a taxable sales transaction of one dollar South San Francisco currently receives one cent from the State and the remainder is paid to other public agencies including the State and the County.

The minimum combined sales tax rate for San Francisco California is 85.

Safest Neighborhoods In San Francisco What Are The Safest Areas In San Francisco To Live

Stripe Offers Cash To Workers Willing To Leave San Francisco Will Other Companies Follow San Francisco Business Times

At The Heart Of The European Commission S Investigations Of Apple Is A Basic Question How Should Apple Make Money Pro Market App Ecosystems App Store

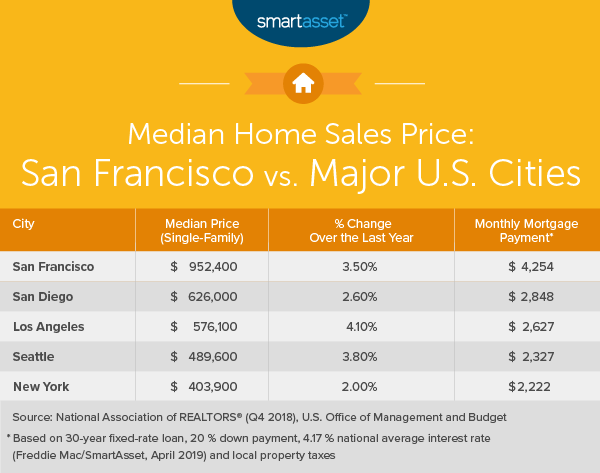

What Is The True Cost Of Living In San Francisco Smartasset

144 Dundee Dr South San Francisco Ca 94080 Mls 422682387 Redfin

560 Haight St 106 San Francisco Ca 3 Beds 3 Baths Home Home Values Home Decor

South San Francisco Economic And Community Development Department

102 Sycamore Ave South San Francisco Ca 94080 Mls Ml81885955 Redfin

Finance Department City Of South San Francisco

How Do State And Local Sales Taxes Work Tax Policy Center

South San Francisco Economic And Community Development Department

Secured Property Taxes Treasurer Tax Collector

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Finance Department City Of South San Francisco

Downtown Vs Neighborhoods S F Sales Tax Data Shows Where People Are Spending Their Money

Bay Area Housing Market Sees Rise Of Second Home Sales

South San Francisco Economic And Community Development Department

South San Francisco Economic And Community Development Department